Things about Tax Services

Table of ContentsSome Ideas on Tax Services You Should KnowSome Known Factual Statements About Tax Services 5 Simple Techniques For Tax ServicesTax Services Can Be Fun For AnyoneThe Ultimate Guide To Tax Services

While it might be very easy to make presumptions and apply cookie cutter options, this is not the way Deliberate Bookkeeping methods tax preparation. Establishing a long-lasting tax obligation method uses you lots of advantages, and savings add up to possibly tens of thousands of dollars or more over time.The advantages of tax obligation preparation come from using the tax obligation legislations to your benefit. Good tax planning functions within the rules set by the federal government. Tax Services.

While the advantages of tax planning are substantial, there are some obstacles to think about. Tax preparation needs time and initiative to comprehend the rules.

Unknown Facts About Tax Services

to match various residential or commercial property values Adaptable repayment period of approximately 32 years No repossession costs for specific borrowers with drifting rate of interest Quick approval within two days * Balance transfer center with top-up lending choices as much as Rs. 1 crore These functions make home possession more affordable and obtainable. The tax obligation advantages on home lending interest and major repayment additionally enhance the benefits of tax planning.

Download the application or contact a rep to find out more concerning their home lending options and exactly how they can match your tax obligation planning approach.

Use tax obligation deductions to minimize your taxed revenue. Business tax obligations you pay will certainly be based upon your decreased income quantity. Take into consideration taking the complying with tax deductions to support your small company tax obligation planning technique. If you're a homeowner and have a regular and well established work environment in your house, the connected prices can be subtracted from your tax obligations.

See This Report on Tax Services

A simple method to do this is by contributing to a charity. Numerous charities will give a year-end declaration to their routine donors, yet keeping an eye on your offering through itemized deductions is crucial. The QBI reduction enables a small company owners that operate as a pass-through entity business framework to subtract approximately 20% of internet business income.

They might instead select to conserve for retired life through a Roth individual retirement account, which can not be deducted from their tax obligations. Saving for retirement is one more outstanding tax planning method for small companies. It can assist them save money and better comprehend their tax expenses. Apart from boosted wages, the ideal workers move to companies providing excellent benefits and various other incentives.

This technique can lower your earnings and minimize your tax burden.The maximum amount for a capital loss in 2025 is $3,000. Any kind of amount over that can be put on the following year (Tax Services). You can attempt to prepare your tax approach on your own, yet you could not obtain constantly great results as you would collaborating with a tax obligation preparation specialist

The Facts About Tax Services Revealed

Scammers are devoted to deceiving taxpayers, often by posing the IRS and demanding prompt repayment. The IRS will certainly never call, message, or email a specific and demand look at these guys payment or individual info. When in doubt, contacting the internal revenue click here for more service directly with their site is best to validate the reputable notices you receive.

The IRS catches the mistakes, fixes them and proceeds in many cases. In others, a mistake can bring about an audit or a charge tax obligation later on. No issue exactly how it obtains dealt with, any mistake can delay your tax obligation refund. Tax obligation preparers know enough with the procedure of submitting income tax return that the likelihood of them slipping up is significantly less than a person doing it.

The Of Tax Services

Their objective is to get your tax obligation bill as low as feasible. It takes time to prepare a tax return, and the time you may spend preparing your or your organization's taxes can be better invested doing something else.

Discover out exactly how much and exactly how you'll pay the tax obligation specialist. Choose a tax obligation preparer that does not bill based on the dimension best site of the reimbursement.

Purposefully asserting a tax obligation debt is an additional vital element of company tax planning. A tax obligation credit rating directly reduces the amount of tax owed, making it extra helpful than tax obligation reductions. Services ought to identify and prioritize a tax credit history that lines up with their tasks, such as those for renewable energy financial investments or working with employees from targeted teams.

Mara Wilson Then & Now!

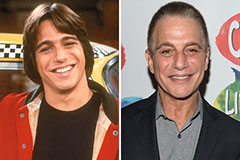

Mara Wilson Then & Now! Tony Danza Then & Now!

Tony Danza Then & Now! Melissa Joan Hart Then & Now!

Melissa Joan Hart Then & Now! Lucy Lawless Then & Now!

Lucy Lawless Then & Now! Kerri Strug Then & Now!

Kerri Strug Then & Now!